Subtotal: $ 50,828.00

Hybrid Crypto Exchange Improvement In 2025 Features Benefits-

Furthermore, buying and selling volume on these exchanges has skyrocketed, registering a whopping 400% improve over the same interval. These metrics, coupled with a significant rise in the variety of hybrid sales and a drop in security incidents, reaffirm the rising influence of hybrid exchanges in the crypto buying and selling landscape. They present the liquidity of centralized exchanges while permitting customers to retain control over their non-public keys, enhancing security. A user-friendly interface can considerably improve your trading experience on a hybrid trade.

The growth of a hybrid crypto trade platform requires important Mining pool monetary prices. Therefore—you must monetize your cryptocurrency buying and selling platform to offset these prices. Hybrid exchanges improve security by combining the best elements of decentralized and centralized platforms. Hackers are much less more doubtless to succeed if customers maintain control of their money. Multi-signature wallets, decentralized features and superior security all assist keep funds safe from hacks and other people who mustn’t have access to them.

Tools & Resources

These risks can significantly impression users’ funding and monetary well-being. Therefore, it’s important to decide on a trusted platform and take necessary precautions, corresponding to two-factor authentication and cold storage. Decentralized exchanges (DEXs) are autonomous cryptocurrency buying and selling platforms that operate with out the involvement of a government. Creating a consumer friendly and intuitive experience must be the primary aim of the design section. A hybrid cryptocurrency change takes one of the best components of each decentralized exchanges (DEX) and centralized exchanges (CEX) like how simple it’s to make use of.

Breaking: Major Platforms Launch Free Crypto Exchanges

The future chapter of DeFi will in all probability be outlined by its interaction with institutional actors and regulators. Whereas the hazards of smart contract defects and market fluctuations are commonly recognized, DeFi also poses deeper systemic issues that go underappreciated. There’s more—we’ve rolled out a suite of new merchandise to make buying and selling crypto on Robinhood even more https://www.xcritical.in/ powerful and seamless. European prospects may have access to 200+ US inventory and ETF tokens.

Binance and Coinbase present zero-fee pairs while maintaining sturdy security. Our recommendations recommend utilizing a quantity of platforms strategically for different buying and selling approaches. Merchants ought to check platforms carefully using thorough risk assessments. State cash transmission licenses create a patchwork of availability across the US.

- The inherent scalability of hybrid exchange platforms factors in the course of their potential to emerge as pivotal hubs in the future of cryptocurrency trading.

- Traders ought to select exchanges with a large person base and high trading volumes to make sure enough liquidity for his or her trades.

- Hybrid exchanges minimize centralized system points by spreading the laid throughout a number of networks.

- But their design relies upon central management, bureaucratic oversight, and intermediaries to supply belief and compliance.

- Understanding the concept of hybrid cryptocurrency exchanges offers traders with a new lens to view and navigate the dynamic world of cryptocurrency trading.

Future success is dependent upon informed decision-making somewhat than chasing the bottom marketed charges. US merchants must stability charge savings with regulatory compliance and insurance coverage safety. The instruments in this analysis assist confirm platform claims and calculate real trading costs.

As awareness and acceptance of cryptocurrencies broaden, they’re more and more seen as attractive funding avenues. The creation of hybrid exchanges is reworking the cryptocurrency panorama right into a safer, more accountable, and information-rich environment for executing transactions. By merging safety and liquidity, hybrid exchanges deliver a seamless buying and selling experience appropriate for each type of users. Nash, as an example, makes use of an off-chain matching engine for centralized-level velocity whereas letting customers keep management of their belongings.

This shift is paving the way for deeper connections between decentralized finance (DeFi) and conventional financial techniques. DeFi is mostly governed by token holders that vote on elementary protocol choices. The democratic model often includes What is a Hybrid Crypto Exchange governance tokens—cryptocurrencies that entitle voters to vote. Token holders similar to UNI (Uniswap) or COMP (Compound) holders can vote on and recommend alterations to the protocol, similar to fees, new functionalities, or collaborations.

Anticipated regulatory updates will further shape how these platforms handle compliance. At Comfygen, we use creativity and teamwork to form the direction of know-how. Our innovative options help organisations stay forward of the times in a world that’s changing rapidly. To counter this, plenty of tasks are testing quadratic voting, status techniques, or decentralized autonomous organizations (DAOs) that seek to share governance more evenly.

All transactions on a blockchain are public and can’t be modified, eradicating corruption or fraud potential. Users control their cash at all times, by no means having to belief someone else. This launch will mark an important step in serving lively merchants throughout the globe with superior trading instruments in an intuitive platform.

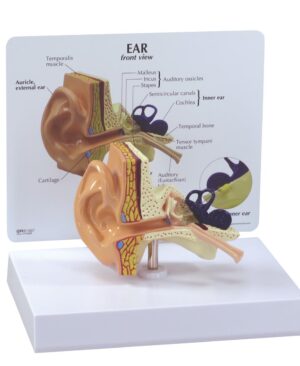

Modelo de oído infantil

Modelo de oído infantil  Modelo de tracto GI

Modelo de tracto GI  BONElike™ Cráneo – Cráneo didáctico de lujo, 7 partes

BONElike™ Cráneo – Cráneo didáctico de lujo, 7 partes  Bebé de cuidado Femenino

Bebé de cuidado Femenino